Identity theft is one of the fastest-growing crimes today, affecting millions of people globally each year. Criminals steal personal information such as names, dates of birth, Social Security numbers, or financial account details to impersonate victims, open accounts, commit fraud, or drain savings. The consequences can be devastating, including financial loss, damaged credit, and stress that takes months or even years to resolve. Fortunately, identity theft is largely preventable through careful practices, smart habits, and proactive security measures.

In this guide, we will explore the most effective strategies to protect your personal information, both online and offline. These practices are based on insights from security experts, financial authorities, and consumer protection agencies, designed to help you stay safe, aware, and empowered to prevent criminals from misusing your identity.

What Is Identity Theft?

Identity theft occurs when someone uses your personal information without your permission to commit fraud or other crimes. This can include opening credit accounts, accessing your bank accounts, making purchases in your name, or even creating fake identities. Methods criminals use include phishing emails, malware, data breaches, stolen mail, and unsecured public Wi-Fi networks. Once your information is stolen, the consequences can range from minor financial inconvenience to major financial and legal problems that take years to recover from. Understanding the ways identity theft occurs is the first step toward effective prevention.

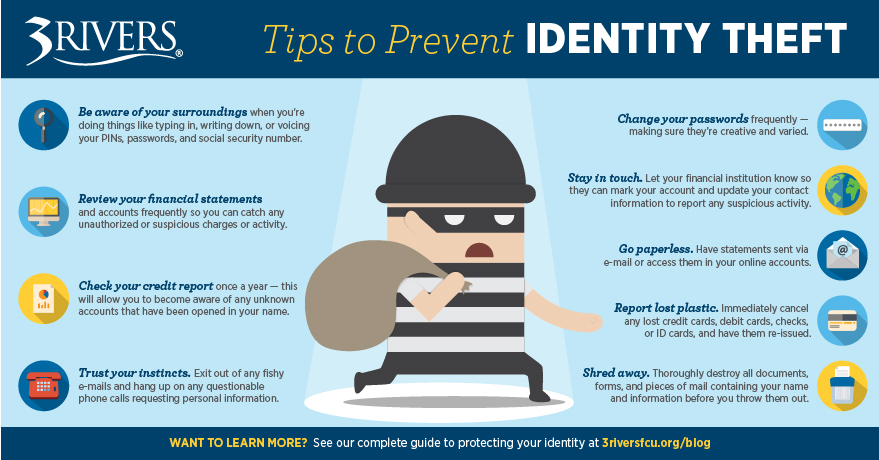

Top Identity Theft Prevention Strategies

1. Protect Personal Information Offline

Keeping sensitive information secure offline is the first line of defense. Avoid carrying your Social Security card, important identification, or sensitive documents in your wallet. Store them in a safe, secure place at home. Shred bills, bank statements, tax documents, or medical records before disposing of them. Retrieve your mail promptly and request a hold when you are away. Thieves can easily steal mail to gather enough personal information to commit fraud.

2. Secure Digital Accounts and Devices

Your online presence is a common target for identity thieves. Use strong, unique passwords for every account. A password manager can help you keep track of them safely. Enable two-factor authentication on all accounts that support it; this adds a crucial layer of protection even if someone knows your password. Avoid conducting sensitive activities on public Wi-Fi networks, or use a virtual private network (VPN) for encryption. Regularly update devices, apps, and software to patch vulnerabilities that could be exploited. Cybersecurity is essential to protect personal and financial information.

3. Monitor Financial and Credit Activity

Monitoring your finances helps detect suspicious activity early. Check your credit reports regularly for unfamiliar accounts or inquiries. Consider placing a credit freeze on your accounts to prevent new credit from being opened in your name. Banks and credit card companies often offer alerts for unusual transactions — set them up to be notified immediately if suspicious activity occurs. Early detection is key to minimizing damage from identity theft and stopping criminals before they cause serious harm.

4. Be Cautious with Emails and Online Links

Many identity thieves rely on phishing emails or fake websites to steal personal information. Avoid clicking on links or downloading attachments from unknown sources. Be skeptical of unsolicited messages claiming to be from banks, government agencies, or online services — always verify their authenticity by contacting the organization directly using official numbers or websites. Avoid sharing personal information via email or online forms unless you are sure of the source. Awareness and caution are your best defenses against online scams.

5. Take Immediate Action if Identity Theft Occurs

Even with the best precautions, identity theft can still happen. Acting quickly can minimize damage. Contact your financial institutions immediately and report suspicious transactions. Place a fraud alert or credit freeze with credit bureaus to prevent additional misuse of your information. Document every step you take, including phone calls, emails, and correspondence. Prompt reporting increases your chances of recovering lost funds and helps authorities track and prevent further criminal activity.

Additional Smart Practices

-

Limit personal information shared on social media. Oversharing birthdays, addresses, and travel plans makes it easier for thieves to impersonate you.

-

Protect your children’s personal information. Minors’ identities are often targeted because they have clean credit histories.

-

Consider professional identity monitoring services for ongoing surveillance, particularly if you have been a victim of data breaches or identity theft.

-

Use secure payment methods such as credit cards instead of debit cards, as credit cards often provide better fraud protection.

-

Stay educated on emerging threats, including new phishing scams, malware, or social engineering tactics used by criminals.

Common Identity Theft Scams

Understanding common scams can help you avoid them:

-

Phishing emails and texts: Messages asking for personal information or login credentials.

-

Credit card fraud: Using stolen card information to make unauthorized purchases.

-

Account takeover: Hackers gain access to online accounts to steal funds or information.

-

Mail theft: Stealing bank statements, checks, or tax documents.

-

Impersonation scams: Fraudsters pretend to be you or an authority figure to manipulate others into giving them access to your data.

By recognizing these scams, you can avoid common mistakes that make identity theft possible.

Read More: USA.gov: Your Official Gateway to U.S. Government Services

Conclusion

Preventing identity theft is about vigilance, awareness, and proactive action. Criminals exploit simple mistakes, such as weak passwords, unsecured documents, or careless online behavior, to steal personal information. By using strong and unique passwords, enabling two-factor authentication, monitoring credit and financial accounts, and securing both digital and physical information, you can dramatically reduce your risk.

Additionally, being cautious about emails, links, and social media sharing, as well as acting immediately if theft occurs, are critical steps to protect your identity. Education and consistent habits are your strongest defenses. Understanding how identity theft occurs empowers you to safeguard your personal data and maintain control over your financial and personal life. Staying proactive not only prevents financial loss but also reduces stress and helps ensure your identity remains your own, giving you peace of mind in an increasingly connected world.

FAQs

1. What should I do immediately if my identity is stolen?

Report it to your bank, credit bureaus, and authorities. Place a fraud alert or credit freeze and document all steps taken.

2. How often should I check my credit report?

At least once a year, and more often if you notice suspicious activity.

3. Can identity theft happen offline?

Yes, thieves can steal wallets, mail, or physical documents to commit fraud.

4. What is the difference between a fraud alert and a credit freeze?

A fraud alert warns lenders to verify your identity; a credit freeze prevents access to your credit file entirely.

5. Is two-factor authentication really necessary?

Yes, it provides an extra layer of security, making it harder for thieves to access accounts even if they have your password.