In today’s fast-paced digital era, traditional banking no longer meets the needs of many users. Enter the Coyyn Com Banking App, a modern solution designed to bring banking directly to your fingertips. This app provides users with seamless online banking, real-time money management, and advanced security features—all in a single, user-friendly platform. Unlike traditional banks limited by operating hours and physical branches, Coyyn operates entirely online, offering convenience and speed for everyday financial tasks.

The platform combines modern fintech innovations like AI-powered budgeting, multi-currency support, and blockchain-enhanced security with essential banking functions such as transfers, bill payments, and expense tracking. Whether you are a freelancer, business owner, traveler, or someone who simply wants better control over your money, Coyyn provides a reliable, efficient, and secure banking experience. By bridging the gap between traditional banking and digital innovation, Coyyn is redefining how we manage money in the 21st century.

1. What Is the Coyyn Com Banking App?

The Coyyn Com Banking App is a digital financial platform that streamlines money management for individuals and businesses. Unlike traditional banks, it does not rely on physical branches. Instead, it offers full access to banking services through a mobile app and online dashboard. Users can check balances, make instant transfers, track spending, pay bills, manage multiple currencies, and even handle cryptocurrencies—all from a single platform. This combination of everyday banking tools and modern financial technology makes Coyyn suitable for users looking for convenience, efficiency, and control over their finances.

2. Key Features That Set Coyyn Apart

User-Friendly Interface

Coyyn is designed to be intuitive, with a clean dashboard showing balances, transactions, and key tools. Both beginners and advanced users can navigate it easily.

24/7 Access and Global Availability

As a fully online platform, Coyyn allows users to bank anytime, anywhere, making it ideal for travelers, remote workers, and international business owners.

Real-Time Transactions

Transfers, payments, and balance updates happen instantly, eliminating delays common with traditional banking systems.

Multi-Currency and Digital Wallet Support

Users can manage multiple fiat currencies as well as cryptocurrencies, enabling convenient international transactions and asset diversification.

AI-Powered Budgeting Tools

Coyyn analyzes spending patterns and provides personalized insights, helping users make smarter financial decisions.

Blockchain-Enhanced Security

The platform uses multi-factor authentication, biometric login, and blockchain verification to ensure high-level security for transactions and data.

3. How Coyyn Com Banking App Works

Getting started with Coyyn is simple:

-

Sign Up: Create an account using your email, phone number, and personal details.

-

Verify Identity: Upload necessary identification documents for security and compliance.

-

Link Accounts: Connect bank accounts, cards, or digital wallets.

-

Start Banking: Use the app or web dashboard to make transfers, pay bills, track spending, and manage assets.

Once set up, all banking functions are accessible in real time without visiting a physical branch.

4. Benefits of Using Coyyn

Convenience and Speed

Coyyn eliminates the need for in-person visits, providing instant access to all banking functions.

Lower Fees

Online operations reduce overhead costs, allowing the app to offer lower fees compared to traditional banks, especially for international transfers.

Secure and Transparent

End-to-end encryption, blockchain security, and instant fraud alerts help protect user accounts.

Comprehensive Financial Management

AI-driven insights and budgeting tools allow users to track expenses, set financial goals, and optimize spending.

Business-Friendly Features

Coyyn supports invoicing, payroll, and multi-currency accounts, making it ideal for freelancers and small business owners.

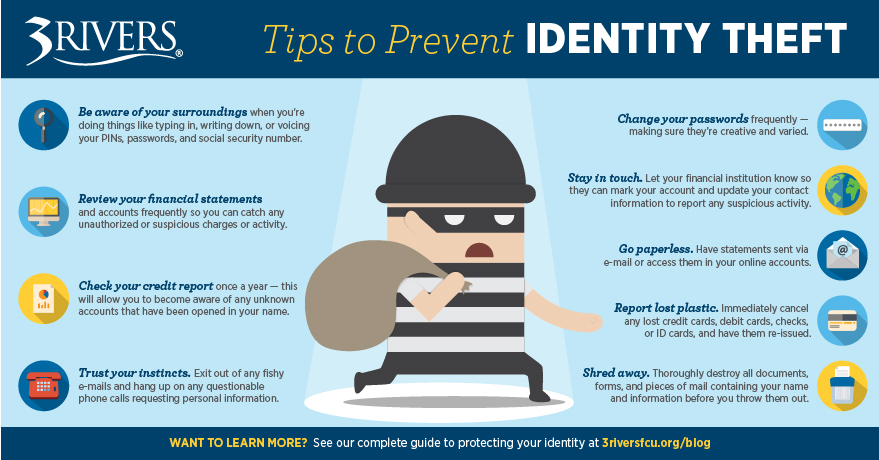

5. Security: Why It Matters

Security is one of Coyyn’s top priorities. Features include:

-

Biometric Logins: Fingerprint or facial recognition for fast, secure access.

-

Multi-Factor Authentication: Extra verification steps prevent unauthorized access.

-

Blockchain Verification: Immutable transaction records prevent fraud and tampering.

These measures protect users’ money and personal data, building trust in a fully digital platform.

6. Who Should Use Coyyn Com Banking App?

Coyyn is ideal for:

-

Freelancers and Remote Workers: Easy invoicing and quick payment options.

-

Global Travelers: Multi-currency accounts and instant international transfers.

-

Young Professionals: Smart budgeting tools and digital access for daily financial needs.

-

Small Business Owners: Efficient financial management with business-focused tools.

-

Anyone Seeking Simple Banking: Convenient, modern alternative to traditional banks.

7. Common Misconceptions and Considerations

While Coyyn offers many benefits, it is important to consider:

-

Regulatory Compliance: The app follows international banking regulations, but availability may vary by country.

-

No Physical Branches: Users must rely on digital support for customer service.

-

Internet Dependency: Stable internet is required for most transactions and account management.

8. Real-Life Use Cases

-

Freelancer Abroad: Sends invoices and receives payments in multiple currencies with minimal fees.

-

Traveler: Manages expenses in different countries without currency conversion hassles.

-

Small Business Owner: Tracks expenses, pays employees, and monitors cash flow in real time.

-

Young Professional: Uses AI tools to budget monthly expenses and save efficiently.

-

Crypto Investor: Stores and trades digital currencies alongside traditional money in one platform.

Read More: Why BottleCrunch.com Is a Must-Visit Digital Guide

Conclusion

The Coyyn Com Banking App is redefining digital banking by combining modern technology with essential financial services. Its focus on convenience, security, and intelligence makes it a strong alternative to traditional banks. Real-time transactions, multi-currency wallets, AI-driven budgeting, and blockchain security provide users with control, speed, and peace of mind. While fully digital banking may require stable internet and adaptation for users accustomed to physical branches, the app’s advantages—lower fees, global access, and smart financial insights—outweigh the limitations.

Coyyn is especially valuable for freelancers, small business owners, international travelers, and anyone seeking a flexible, efficient, and secure way to manage money. As the financial world continues to evolve, apps like Coyyn are leading the charge, making banking faster, safer, and smarter. For anyone wanting a seamless, modern, and intelligent banking experience, Coyyn Com is shaping the future of personal and business finance.

FAQs

1. What makes Coyyn Com better than traditional bank apps?

Coyyn offers lower fees, instant transactions, AI budgeting tools, multi-currency support, and modern security features.

2. Is Coyyn Com Banking App secure?

Yes. It uses multi-factor authentication, biometric logins, and blockchain verification to protect accounts.

3. Can I use Coyyn for international payments?

Absolutely. Coyyn allows real-time transfers and supports multiple currencies for global transactions.

4. How does Coyyn’s budgeting feature work?

The app analyzes spending, categorizes expenses, and provides personalized advice to help users save and budget.

5. Does Coyyn support cryptocurrency?

Yes. Users can manage digital currencies alongside traditional money within the same platform.